I Got Hit by a Bread Truck in France: Would Travel Insurance Have Even Helped?

One of the big questions in travel planning is Do You Actually Need Travel Insurance? It’s also one of the questions I’ve consistently ignored… But after an accident in France, I think I’m finally learning my lesson.

For years, I’ve confidently told friends and family, “Yes, you should get travel insurance. It doesn’t cost very much. It gives you peace of mind. And it can even protect your luggage and camera equipment.”

And then I’ve always been too cheap to take my own advice. The truth is, after visiting or living in 40-some countries, I personally have never purchased travel insurance for myself. Not once.

That’s not to say I shouldn’t have, and this is definitely a do as I say, not as I do type of story. Because by my count, I’ve ended up in an ER or foreign doctor’s office no less than 7 times.

And now, the coup de grâce: On a late autumn trip to the dangerously photogenic French city of Strasbourg, I finally began learning my lesson.

Hit by a Car in France – How did that happen?

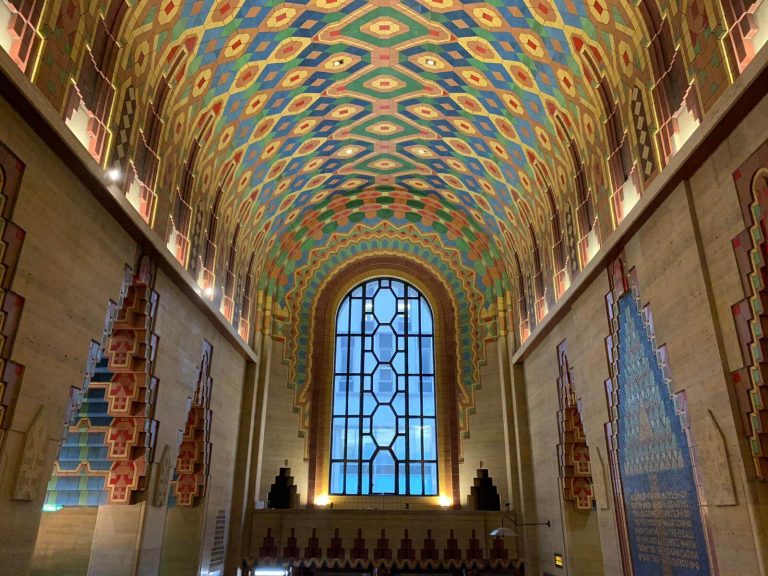

I arrived in Strasbourg by train, from the Bavarian city of Nuremberg, on a drab and rainy afternoon.

But the next day, bathed in bright winter sunshine, Strasbourg was absolutely glowing.

I finally pulled out my big camera – which I’d been lugging around for three weeks, taking up precious space in my carry-on only packing strategy.

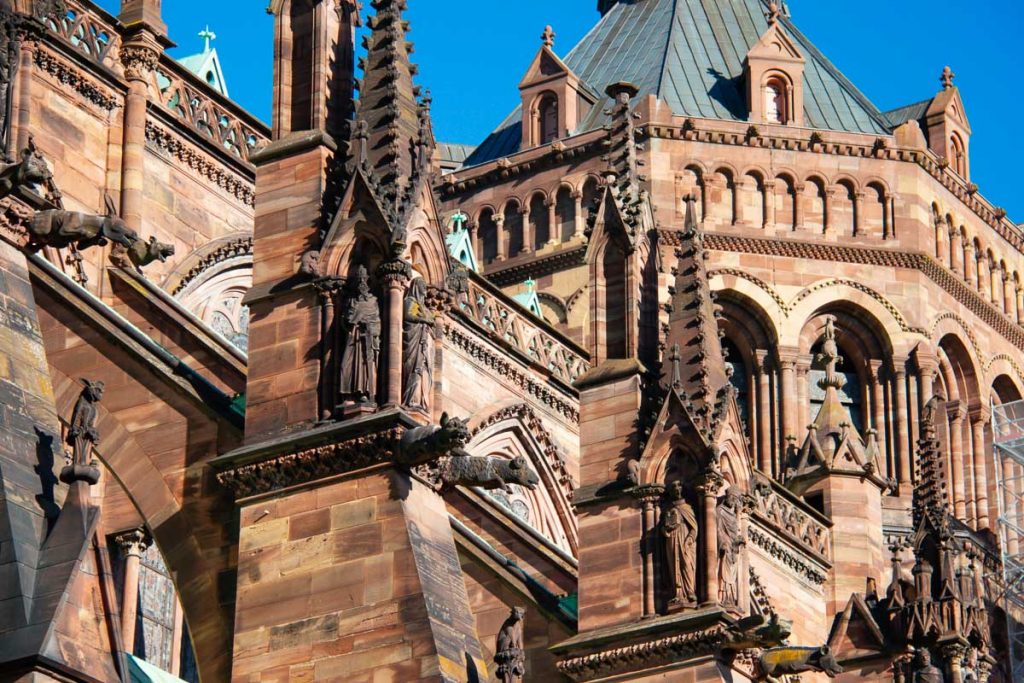

After a croissant and an oat milk cappuccino, I found myself standing in front of the Strasbourg Cathedral (in the middle of a pedestrian plaza, I might add), admiring the details on the church’s famous Gothic façade, with a local man next to me pointing out architectural details.

All I remember is lifting my camera up and zooming in to take a photo, and then WHAM – I was on my back, under a bread delivery van.

I didn’t see where it came from, but there was only one pathway where a car could possibly fit (through the Christmas market stalls being set up). The van hit me straight on, knocked me down, and only stopped with its front tire parked on top of my foot and ankle.

Unfortunately, that is not an exaggeration.

Bystanders – including my architect friend, who’d apparently jumped out of the way without warning me – had to yell at the driver, first, to get him to stop. And then to get him to back up off of my foot. If they hadn’t been there, he would have continued driving the van straight up my leg.

The driver said he never saw me at all, which is terrifying, because I hadn’t moved a muscle. And because it was a pedestrian area, and that’s literally the most important thing to do while driving – not hit people. And he’s still out there, roaming the streets of France with a driver’s license.

Luckily, I wasn’t too badly injured.

The driver gave me his contact information – after one of the helpful French witnesses insisted. (I was too much in shock to even think of asking for it, which really highlighted how even a minor trauma can make a person not think straight.)

So with his bakery business card in hand, I limped off to catch my train an hour after the accident. One of the bystanders also gave me his contact info, and emailed me a signed document testifying to exactly what he’d seen.

French ER Visit & Insurance Drama

The next day, swollen and achy, I went to a small-town French ER, where an x-ray confirmed that my ankle was solidly sprained, but not broken. The doctor wrote me an official note (certificat de constatation) to send the insurance companies, saying that I was indeed injured. And the front desk said they’d send the ER bill to my door in Boston. (Which they did… more on that at the end.)

Slightly worse, though, was that my cracked, $600 camera lens had just missed getting a Black Friday upgrade.

And most irritating of all was that, while I did have the driver’s insurance information, I learned that French insurance companies will only talk to (or pay) other insurance companies. Not individuals. It seemed that I didn’t even have a way to submit my documents (from the witness and the doctor) to anyone who cared.

Instead, I just had to depend on the driver’s word that he would submit the accident to his insurance. But really, why would he?

While I do speak passable French, luckily, I was visiting a local friend in France. She helped me immensely by making lots of calls to figure out the bureaucracy. The consensus was that I needed to get my US health insurance company (or my travel insurance company, if I’d had one) to talk to the driver’s insurance. My confidence in this working was… let’s just say minimal.

What to do if you get in a car accident in France:

The other consensus, from every government office we called, was that I should have filled out an accident report – called un constat – at the scene of the accident, with the driver. And I should have called the police or fire department to the scene, to make an official record of what had happened.

So when I got home to the US, I picked up the phone to call my health insurance company and explain the situation.

A very helpful, sympathetic call center employee explained that they had absolutely no process for interacting with a foreign insurance company, and would not under any circumstances be able to accept payment from one on my behalf.

I countered weakly with, “What about just… to represent me, so they’ll pay for my camera?”

“Oh… yeah… We don’t care about your camera. I’m sorry.”

Exactly as I’d expected. So then this – this exact situation – might be the point of buying travel insurance. I was starting to get it. (And my wallet was getting it, too. As I tallied up below, this fairly minor accident ended up costing me about $1,250.)

Would travel insurance have actually helped?

Okay, so it makes sense that my experience without travel insurance hasn’t been ideal this time. But for this article, I wanted to understand whether it would have actually been any different with travel insurance.

The short answer: Yes… probably. But since I didn’t get a police report of the incident, it’s hard to know for sure whether a travel insurance company would have accepted my claim. Here’s how I learned that:

There are two insurance brokers I normally recommend to readers, friends and family – especially those coming to the US. (Travel insurance isn’t usually required to enter the US, but it would be… a very bad idea to come here without it. Our medical system is incomprehensibly expensive, so please don’t risk it.)

Those two brokers are Travel Insurance Master and Insure My Trip.

So I looked up how much good, comprehensive plans would have cost from each of them, considering the main factors that affect the price of travel insurance:

- Age of the traveler (I’m in my 30s)

- Country visited – or usually the first country on the itinerary, if multiple. (Czech Republic)

- Price of the trip (I put an estimate of $2,500, although it was probably less)

- Dates and duration (I couldn’t enter a date in the past, of course, but I used the same 3-week trip duration)

- Traveler’s country of residence (US for me these days)

The policy prices they returned ranged from about $60 to $200, with most well under $100.

(And remember, this was for top-notch travel insurance policies, with all the bells and whistles. I checked the box for “trip cancellation plans” on Travel Insurance Master – meaning trip cancellation plus coverage for delays, medical, etc. On Insure My Trip, I filtered for “comprehensive plans.”)

Then I got in touch with both companies, and asked about my trip as a sort of hypothetical situation. (“If I had had travel insurance when I got hit by a truck in France, would it have covered me? Would it have covered my broken camera? What would I have needed to do to submit a claim?”)

Here’s what they said:

What I Learned from Travel Insurance Master:

Travel Insurance Master gave the most useful answer after an initial email. (But I was contacting them as a travel blogger, not as a normal customer.)

Their founder got back to me with a list of what I would need to submit a claim, and what to expect. The first point:

- Most travel insurance policies – if not all – do cover luggage and camera equipment.

According to Travel Insurance Master, this is what I would need to submit a claim for my camera:

- A police report listing a broken camera – which I didn’t get but definitely should have!

- A purchase receipt or repair receipt for the camera from a repair shop (the insurance company might also accept a replacement receipt)

More points to keep in mind if you have medical trouble abroad:

- Always try to document as much as possible – with photos, receipts, and anything official you can get, like police and doctor’s reports.

- For medical bills abroad, the rule of thumb is that if the amount is small, you would pay out-of-pocket and file a claim for the insurance company to reimburse you. But if it’s something dramatic, requiring hospitalization, then you’d contact your travel insurance company and they may arrange direct payment to the hospital.

What I Learned from Insure My Trip:

Insure My Trip is known for having great customer service, and I have to say, it didn’t disappoint. (When you’re looking at plans, a popup on their website will ask if you want to chat with an agent – and it’ll be a real person who actually knows the business.)

I got quite a bit of useful information from several chats while digging into this.

- First, I learned that my broken camera would only have been covered by a Comprehensive plan.

- To figure out how much a plan might cover a camera for, you put in your trip information, then select a few Comprehensive policies to compare. On the comparison page, scroll down to “Baggage Loss,” and click the dollar amount listed there to learn what’s covered and what’s not. Many plans listed a “per article limit” of $300 to $500, which applied to camera gear.

- A few plans gave a check box (listed under the “Baggage Loss” section) to add additional insurance coverage for “Electronic Equipment” (surprisingly, for just a couple of dollars more). That would probably be a solid idea, but unfortunately there’s no way to filter for plans with that option.

Quick Comparison:

Both Travel Insurance Master and Insure My Trip are brokers that sell policies from dozens of insurance companies. The options and prices are very similar – it’s mostly just a matter of which interface you find easier to use. Personally, I find Insure My Trip a little easier and appreciate the ability to get fast answers via chat.

|

Description: The largest travel insurance broker in the US, so they have a wide variety of plans that you can compare side-by-side. You can go with a basic “travel medical” plan, or filter for plans that include “Cancel For Any Reason” coverage. (And it does mean any reason.) |

Description: Not as well known as others, but offers more variety, and lets you very easily compare plans from different providers side-by-side. I also like that you can choose your own deductible. After selecting a plan, you can check how much of a deductible you want, and it'll automatically update the quote. |

|

Pros:

|

Pros:

|

The largest travel insurance broker in the US, so they have a wide variety of plans that you can compare side-by-side.

You can go with a basic “travel medical” plan, or filter for plans that include “Cancel For Any Reason” coverage. (And it does mean any reason.)

- Great customer service

- Insures travelers of any age

- Filter for clearly marked “Cancel For Any Reason” plans. (And it does mean ANY reason.)

- Most options for travelers not from US

Not as well known as others, but offers more variety, and lets you very easily compare plans from different providers side-by-side. I also like that you can choose your own deductible. After selecting a plan, you can check how much of a deductible you want, and it'll automatically update the quote.

- Lots of variety

- Insures travelers of any age

- "Choose Your Own Deductible" for most plans

(Note: If Travel Insurance Master says there are no plans available for your trip, try changing the “Plan Type” on the left-hand side from “Trip Cancellation” to “No Trip Cancellation.”)

Bonus: What I Learned from World Nomads:

Finally, World Nomads is a good place to start your travel insurance research – because it’s the fastest and easiest place to get a quote. So it’s useful if you just want to get an idea of how much travel insurance could cost.

But unfortunately, they have a new policy that means I can’t share details about what their policies will actually cover, and they couldn’t answer any hypothetical questions about specifics. (Something their lawyers decided.)

But I can say that World Nomads’ policies are simple and flexible. For example, you can buy or extend a policy while you’re already on the road, which is unique. That may be why they’re popular with long-term travelers (and they also insure for short trips, as well).

And by “simple,” I mean there aren’t a ton of policy options with World Nomads. For US residents, all of their policies are underwritten by Nationwide, which means you don’t have as many choices as with the other two above.

Logistics: Do you need travel insurance to go to France?

Whether insurance is actually required to enter France (or anywhere in Europe’s Schengen area) depends on how long you want to stay and where you’re from. If you’re just visiting, the answer is NO if you’re from the US, UK, Canada, Australia, Europe, or most of Latin America.

The answer is YES if you’re from a country requiring a Schengen visa to visit Europe (most of Asia and Africa).

A Response from the French Insurance Company

There’s one more plot twist to this story, and one development that I definitely predicted.

First, the twist: About three weeks after my bread truck encounter in Strasbourg, I opened my mailbox in Boston and found a letter from the delivery driver’s insurance company. (This meant he’d actually submitted the paperwork! That already left me feeling a bit better about humanity.)

The letter stated plainly, and in English:

“You were involved in an accident with our policy holder. Our policy holder was at fault. We will compensate you…”

And it went on to list the documents, receipts, and identification I needed to submit.

I could hardly believe it was real.

(And I didn’t have to actually snail mail the documents back to France; I could email them – but only two at a time. So I proceeded to send 19 attachments in pairs, like some Noah’s Ark of insurance bureaucracy.)

Then, two months after my French ER visit, the bill finally caught up with me.

This is the part I’d predicted. Again, it arrived on paper, from across the ocean.

The grand total for an x-ray and doctor’s visit in a French emergency room? Drum roll, please…. €89. (About the same in dollars, and just like all of my other similar hospital bills abroad, less than $100.)

I paid it online that day, and sent the receipt to the insurance company – my 20th piece of paperwork. Counting that bill, the ankle brace the doctor had prescribed, my cracked camera lens, and several physical therapy appointments, the accident cost me at least $1,250.

(That’s without considering the cost to change my flight to go home a couple days early – instead of wandering around Paris when I wasn’t supposed to be on my foot. Also not counted: missing a few days’ work, the general hassle, and hours devoted to insurance paperwork.)

A week later, a new email from the insurance company said they’d send me €300 while they decided how much they really owed. That’s already a great start! (But I haven’t seen any money yet – I’ll let you know what happens next and update the story here. So far though, at least they seem cooperative.)

UPDATE – February 2023: Still haven’t seen a single euro/dollar, or heard a peep from the French insurance company since they promised me those €300.

UPDATE – March: Still nothing. They’ve also apparently stopped responding to my emails.

But remember, without my own travel insurance, all of this hinged on the fact that the driver who hit me voluntarily contacted his own insurance company – and told them the truth.

He could have just as easily ignored my calls, and never submitted his paperwork. What would I have been able to do about it? Nothing. In that case, without travel insurance, I would have had nowhere to send my 20 documents, and no chance of getting back the $1,250+ that this accident has cost me.

We are preparing for a guided study trip to Israel this summer and your comments on travel insurance are very helpful. We too have never bought travel insurance and, fortunately, haven’t had any serious travel losses yet either. We did notice that our trip’s company, Tutku Tours, mentioned in their brochure that their fee does not include travel insurance. I expect that perhaps somewhere in the fine print they promise NOT to cover injuries or other financial losses.

So, we are now strongly considering the insurance. We will now keep a keen eye out for bread trucks but I am more concerned about tripping getting out of the bus or other common hazards especially since we are not getting any younger.

Thanks for dicussing a very important travel issue.

Aha, believe me, I wasn’t expecting the bread trucks to be a threat either!!

And I’m right there with you – I’ve never bought travel insurance before, for a number of reasons (and that’s a whole separate topic I’ll be posting about soon). But you’re right, I’m sure if the trip specifies that insurance is not provided, it means you’re on your own, if anything happens.

Is there a difference between “Travel insurance” and “Trip insurance “?

There shouldn’t be a difference, but I wouldn’t put it past some companies to decide maybe “trip insurance” just covers eventual cancellations or delays, but not medical/evacuation, or something like that? You never know. I would just recommend sticking to the two companies I mentioned above (Insure My Trip or Travel Insurance Master), since they’re the ones I’ve actually talked with and know to be legitimate.